Please note: This is for information purposes only. It is essential that you refer to the insurance booklet and insurance schedule for full details of the cover provided.

We understand that insurance can seem like a real minefield – but it doesn’t have to be.

We’ve stripped away the jargon to explain in plain English, what cover you need based on your requirements.

We answer some of our customers’ common queries below to help you work out which cover is right for you. If your question is on this list, simply click on the link that applies to you, and it’ll take you to our answer. Hopefully, after reading the below, you’ll have a much clearer understanding of what you’re covered for.

If your question isn’t answered on this page, you can fill out the contact form at the bottom, and someone from our team will be in touch.

Skip to your query

What insurance do I need and why?

You need to know exactly what you’re covered for, and the below summaries should answer your question – we’ve chosen the most common types of cover we provide.

Public Liability

Public Liability will cover you if someone made a claim against you if they were injured through your negligence whilst training them. This will cover things like compensation, court fees and solicitor fees. The injury needs to have occurred during a match or training session that you took part in.

Below are four examples of why you’d need Public Liability:

Example 1 - You’re coaching or instructing someone, and they injure themselves. They hold you responsible for their injuries and make a claim against you.

Example 2 - You’re a player (e.g. a football player), and you seriously injure another player when making a tackle, and they take legal action against you.

Example 3 - You’re a personal trainer, and the client you’re training damages gym equipment that doesn’t belong to you during one of your sessions. You’re held accountable, and a claim is made against you by the owner of the equipment.

Example 4 - You leave a kit bag lying around, and someone trips over it and hurts themselves. They hold you responsible for their injuries and make a claim against you.

Personal Accident

You need Personal Accident in case you sustain a serious injury while practising your sport. Here’s what our Personal Accident cover could provide:

- The amount stated towards expenses for physiotherapy.

- The amount stated towards expenses for emergency dental costs.

- Payment of a lump sum if you suffer accidental death while practising your sport.

- Payment if you become permanently disabled following an accident while practising your sport.

- Payment for loss of limbs or loss of sight following an accident while practising your sport.

When you take out our Personal Accident cover, we also give you the option to add Loss of Earnings cover. Here’s what this provides in a nutshell:

- Financial support whilst you’re out of work and unable to earn an income due to a serious injury you’ve suffered while practising your sport.

- You can claim for Loss of Earnings for up to 52 weeks. Please note, we don’t cover the first 14 days that you’re unable to work.

Equipment cover

You need equipment cover in case the equipment you use to train is stolen or damaged. This cover applies whether you’re practising your sport or not at the time of the incident.

For instance, if you’re a dance instructor and the sound system/speakers you use to stream songs during classes are stolen from the boot your car.

Below are recent examples of why you’d need equipment cover. We have previously dealt with claims for the following scenarios:

Theft

Example 1 - Your sports equipment is kept in the locked boot of your car, and someone breaks into your car and steals it.

Example 2 - You’re a personal trainer conducting an outdoor training session in a park, and you bring bags of equipment with you and someone steals your bags and rides off on their bike.

Example 3 - You run boxing sessions from a community centre. Overnight, someone cuts the bolt off the door, breaks in, and steals your boxing equipment.

Damage

Example 1 - You store your sports equipment in a building, and someone targets the building in an arson attack. Your equipment is damaged beyond repair.

Example 2 - You’re working on the laptop you use for work purposes, and you accidentally drop it on the floor. It won’t turn on, and it’s so badly damaged it requires specialist repair.

Example 3 - You’re taking part in a sport like paddle boarding, and your board gets swept away in the wind and damaged.

Hopefully, the above examples answer your questions. If you’re still unsure what you’re covered for or have a question on a specific form of cover, head to the form below.

What level of Public Liability do I need?

The simple answer is – you need to check with the owners of the venue you’re training at or contact your local council. Different organisations will require different levels of Public Liability.

If you’re self-employed, you need to consider what level of Public Liability you need to cover your court and solicitor fees if a claim is made against you.

We offer up to £10 million of Public Liability depending on your needs.

Do I need to list all of my equipment when I take out equipment cover?

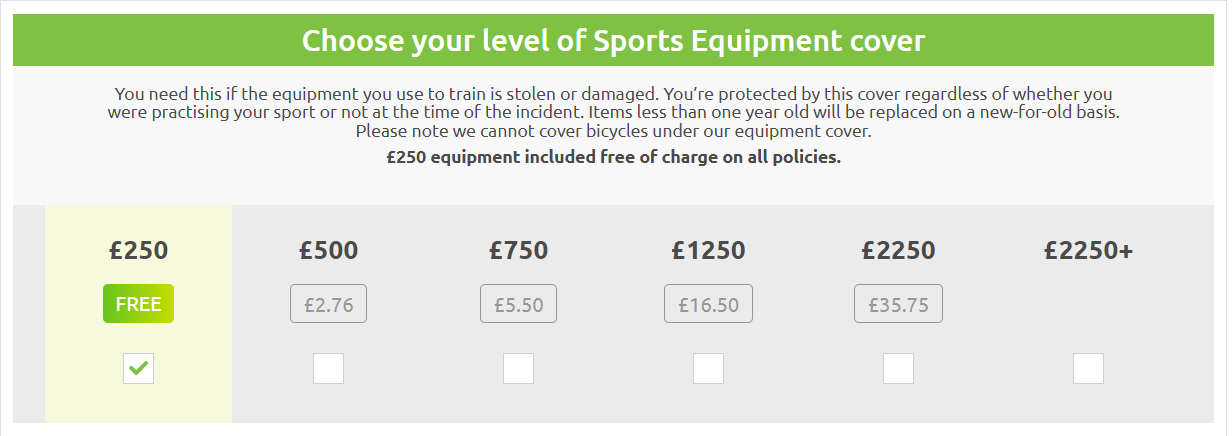

No, you don’t. You just need to select up to the value of equipment cover you want. All we need to know is the total value of your equipment – you can do this by selecting one of the boxes you see below:

The bold value is the total value of your equipment, and the value underneath that is how much your insurance will cost. Monthly payment options are available at checkout if the total cost of your policy is more than £50 a year.

Where can I train and still be covered?

Where you can train depends on the cover you select.

Broadly speaking, as long as you are a UK resident, you’ll be covered anywhere in the UK where you have permission to train when you take out insurance with Insure4Sport.

If you’re lucky enough to train overseas, we offer worldwide cover, including USA and Canada. Again, you must be a UK resident.

Are there age restrictions on who I can train?

There are no age restrictions on the basis you have no restrictions on your qualifications. If you’re unsure whether there are any age restrictions on who you can train, please get in touch with your training course provider.

What qualifications do I need?

To take out our insurance, you need to hold a qualification to a minimum standard. This qualification needs to be recognised by a UK governing body.

Generally speaking, if the qualification you hold isn’t recognised by a UK governing body, you need to have three years’ experience of teaching the sport you want to be insured for.

However, we do require qualifications that are recognised by a UK governing body for certain sports. These are detailed in page 21 onwards of this document.

My question hasn’t been answered

Please fill out the form below with your name, contact details, and details of your query. One of our team will be in touch shortly.

Alternatively, you can visit our FAQs page.

Drop us a line